|

SGF announces a profit for the second straight year

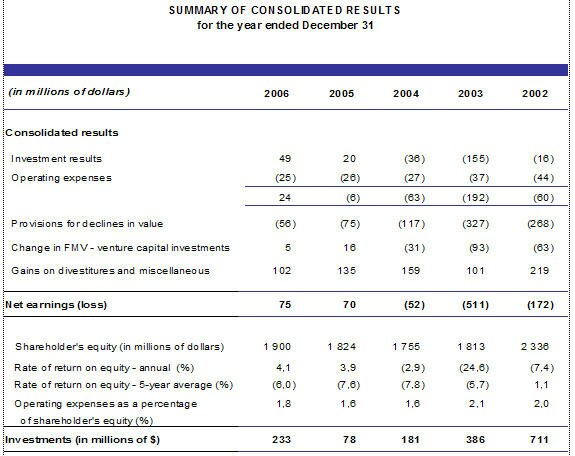

SGF earned $75 million of net income and made $233 million of investments in 2006

Montréal, April 12, 2007 - Société générale de financement du Québec maintained its profitability in 2006 with a 4.1% return, an increase over the 3.9% return it posted in 2005. This return represents $75 million of net income versus $70 million in 2005.

“I’m proud of the work done by the members of our team as they actively pursued the efforts begun in the preceding year,” stated Pierre Shedleur, President of SGF. “In 2005, we completely restructured SGF to make it more effective. In 2006, we resumed our investment operations and filled our pipeline with projects. In line with its mission, SGF has again become an important player in Québec’s sustainable development,” Mr. Shedleur added.

SGF not only increased the profitability it re-established in 2005, but it also became active once again, making more than $233 million of sustainable, constructive investments, in comparison with $78 million in 2005. SGF made these investments in accordance with the three strategic orientations in its business plan.

Strategic orientation 1: Carry out constructive projects with partners from outside Québec

The investments made in 2006 include a stake in an ambitious $270-million project to make 15 feature films. As a result of SGF’s $18-million investment in the project, six of the films will be made in Québec.

All these feature-length films will be entirely developed and produced by Hollywood producer Joel Silver, one of the most dynamic producers in the business. In a career spanning three decades, he has produced almost 80 movies, including major hits such as The Matrix, Die Hard I and II, and Lethal Weapon.

This project represents a total investment of $170 million for Québec, or an average of $28 million per film. The productions will create 1,500 jobs (person-years) over five years and will generate $53 million of wages and $12.4 million of revenues for the Québec government.

By partnering in this way with major film industry players, SGF contributes to the development of Québec’s film industry, in terms of economic spinoffs as well as development of its technology and know-how.

Strategic orientation 2: Assist with the consolidation and expansion of Québec companies in specific sectors

Another of SGF’s substantial investments in 2006 was a $100-million stake in Cascades.

By participating in this way in Cascades’ acquisition of Norampac, SGF is pursuing its mission of contributing to the growth of Québec companies that invest in expanding markets. Mindful of the difficult situation in the forest products sector, SGF is contributing to the growth and merger of companies with the ability to act on business opportunities in promising niches.

Strategic orientation 3: Accelerate the growth of well-managed Québec companies so that they can penetrate new markets

SGF assists Québec’s growth companies so that they can carry out their expansion strategies and optimize their operations. The projects we support must have a significant economic impact in Québec. SGF formed several partnerships with Québec companies during the year.

First, it acquired a 30% stake in the family business Fruits & Passion. The purpose of this investment is primarily to accelerate the company’s expansion outside Canada so that it can meet the increasing demand for its products. Fruits & Passion will enlarge its plant on Montréal’s South Shore, where it produces more than 90% of the products it sells around the world. Not only will this Québec company be able to penetrate new markets in Asia, Europe and the United States, but it will also create jobs in the province.

In 2006, SGF also made a $7-million investment in ORTHOsoft. This publicly traded Québec company is a world leader in the design and marketing of specialized medical navigation software for hip and knee implant surgery.

SGF’s investment will give ORTHOsoft the development capital it needs to accelerate its growth. As a result of this investment, it will be able to consolidate its position as a global leader in the rapidly growing market for computer-assisted orthopaedic surgery.

SGF also partnered with Élevages Périgord by purchasing a 43% stake in the company. Élevages Périgord, located in the Montérégie region, is Québec’s largest producer of duck foie gras and its byproducts. It has close to 50 employees and sells its products in Québec as well as large cities in Ontario and the United States.

SGF’s $2.3-million investment in this $6-million project will help develop a specialty food product niche with strong growth potential. Élevages Périgord will be able to meet increasing demand and step up its presence on the U.S. market.

Outlook for 2007:

Société générale de financement du Québec plans to invest $250 million in Québec’s economy in 2007 while maintaining its profitability.

“We’ve built a solid team of developers, we’ve filled our pipeline with projects and we’re maintaining effective management with a view to profitability. All the ingredients are present to enable us to pursue our mission in the years to come,” Mr. Shedleur stated.

Société générale de financement du Québec (sgfqc.com), an industrial and financial holding company, has a mission to carry out economic development projects, with emphasis on the industrial sector, in co-operation with partners and on standard profitability conditions, in accordance with the economic development policy of the Québec government.

- 30 -

Source:

Marie-Claude Lemieux

Senior Adviser

Communications and Media Relations

Société générale de financement du Québec

Tel.:

|

|